Mar 2, 20221. Beginning Inventory: This is the value of all the goods available for sale at the beginning of the year. In your case, it’s $10,000. 2. Purchases: During the year, the company purchases additional goods to sell. In your case, this amount is $20,000.

Solved On January 1, year 1, a company had the following | Chegg.com

May 17, 2022A company started the year with 10000 of inventory. Lillieandy1115 is waiting for your help. Cost of goods sold equals. During the year the company purchases inventory for 150000 and ends the year with 20000 of inventory. Answered expert verified. The company will report cost of goods sold to equal.

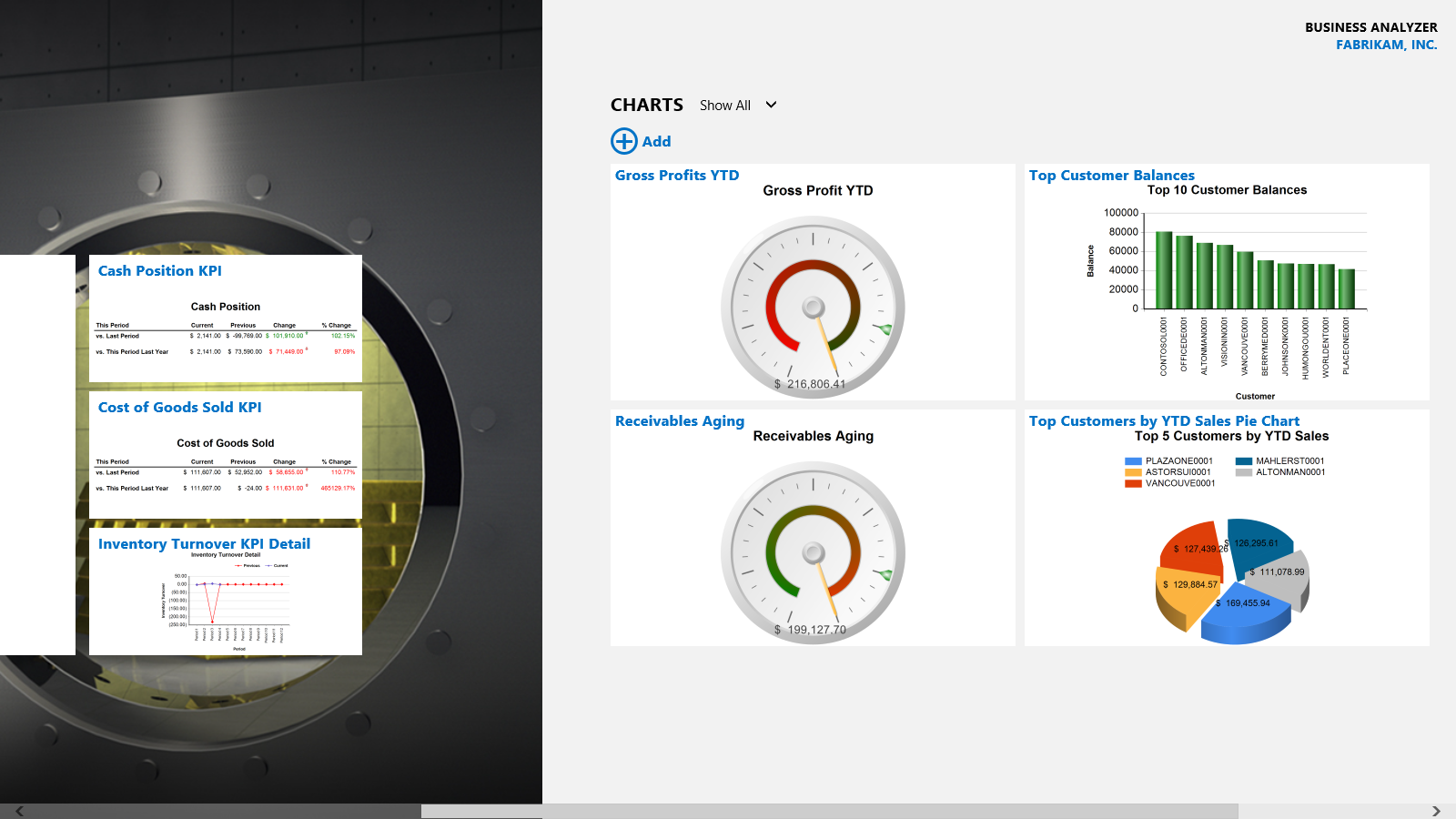

Source Image: dynamicsgpblogster.blogspot.com

Download Image

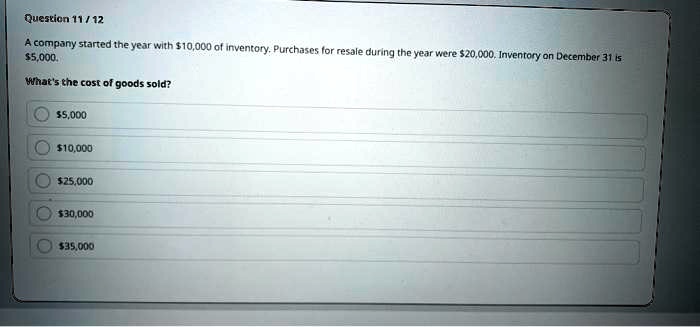

Jun 24, 2023#SPJ11 Complete question: A company started the year with $10,000 of inventory. Purchases for resale during the year were $20,000. Inventory on December 31 is $5,000. What’s the cost of goods sold? Advertisement Still have questions? Find more answers

Source Image: virtasktic.com

Download Image

24 Best Sample Business Plans & Examples to Help You Write Your Own Shaquille Corporation began the current year with inventory of 50,000. During the year, its purchases totaled 110,000. Shaquille paid freight charges of 8,500 for those purchases. At the end of the year, Shaquille had inventory of 47,800. Prepare a schedule to determine Shaquille’s cost of goods sold for the current year.

Source Image: saltlakecommunitycollege.blogspot.com

Download Image

A Company Started The Year With 10000

Shaquille Corporation began the current year with inventory of 50,000. During the year, its purchases totaled 110,000. Shaquille paid freight charges of 8,500 for those purchases. At the end of the year, Shaquille had inventory of 47,800. Prepare a schedule to determine Shaquille’s cost of goods sold for the current year. Jan 27, 2023To calculate the cost of goods sold (COGS), we need to determine the change in inventory during the year. First, let’s find the total purchases for resale during the year by adding the beginning inventory of $10,000 to the purchases of $20,000. $10,000 (beginning inventory) + $20,000 (purchases) = $30,000 (total purchases) Next, we need to find the ending inventory.

College Holds Goldman Sachs 10,000 Small Businesses Graduation

Jan 17, 2024Fast-forward to better TV Skip the cable setup & start watching YouTube TV today – for free. Then save $10/month for 3 months. Question 11/12A company started the year with $10,000 of SOLVED: A company started the year with 10,000 of inventory. Purchases for resale during the year were20,000. Inventory on December 31 is 5,000. What’s the cost of goods sold?5,000 10,00025,000 30,00035,000

Source Image: numerade.com

Download Image

A company started the year with $10,000 of inventory. Purchases for resale during the year were $20,000. – brainly.com Jan 17, 2024Fast-forward to better TV Skip the cable setup & start watching YouTube TV today – for free. Then save $10/month for 3 months. Question 11/12A company started the year with $10,000 of

Source Image: brainly.com

Download Image

Solved On January 1, year 1, a company had the following | Chegg.com Mar 2, 20221. Beginning Inventory: This is the value of all the goods available for sale at the beginning of the year. In your case, it’s $10,000. 2. Purchases: During the year, the company purchases additional goods to sell. In your case, this amount is $20,000.

Source Image: chegg.com

Download Image

24 Best Sample Business Plans & Examples to Help You Write Your Own Jun 24, 2023#SPJ11 Complete question: A company started the year with $10,000 of inventory. Purchases for resale during the year were $20,000. Inventory on December 31 is $5,000. What’s the cost of goods sold? Advertisement Still have questions? Find more answers

Source Image: blog.hubspot.com

Download Image

Mobile marketing trends — how to stay competitive now and in the future Asked by ConstablePorcupineMaster845. A company started the year with $10,000 of inventory. Purchases for resale during the year were $20,000. Inventory on December 31 is $5,000. What’s the cost of goods sold?

Source Image: business.adobe.com

Download Image

Here’s How to Value a Company [With Examples] Shaquille Corporation began the current year with inventory of 50,000. During the year, its purchases totaled 110,000. Shaquille paid freight charges of 8,500 for those purchases. At the end of the year, Shaquille had inventory of 47,800. Prepare a schedule to determine Shaquille’s cost of goods sold for the current year.

![Here's How to Value a Company [With Examples]](https://blog.hubspot.com/hs-fs/hubfs/Value%20a%20Business%20fi%20%281%29.png?width=595&height=400&name=Value%20a%20Business%20fi%20%281%29.png)

Source Image: blog.hubspot.com

Download Image

How to Create a Customer Centric Strategy For Your Business Jan 27, 2023To calculate the cost of goods sold (COGS), we need to determine the change in inventory during the year. First, let’s find the total purchases for resale during the year by adding the beginning inventory of $10,000 to the purchases of $20,000. $10,000 (beginning inventory) + $20,000 (purchases) = $30,000 (total purchases) Next, we need to find the ending inventory.

Source Image: superoffice.com

Download Image

A company started the year with $10,000 of inventory. Purchases for resale during the year were $20,000. – brainly.com

How to Create a Customer Centric Strategy For Your Business May 17, 2022A company started the year with 10000 of inventory. Lillieandy1115 is waiting for your help. Cost of goods sold equals. During the year the company purchases inventory for 150000 and ends the year with 20000 of inventory. Answered expert verified. The company will report cost of goods sold to equal.

24 Best Sample Business Plans & Examples to Help You Write Your Own Here’s How to Value a Company [With Examples] Asked by ConstablePorcupineMaster845. A company started the year with $10,000 of inventory. Purchases for resale during the year were $20,000. Inventory on December 31 is $5,000. What’s the cost of goods sold?